Young Doctors Only: Why Now, Not Later? The Biggest LPS Challenge

The young doctor’s alternative to growing by himself is partnering with a group of experts worth billions of dollars who want to help him create value. He is a great dentist, but his new IDSO partner has created billions of dollars in investment value.

It takes six months for LPS to complete an Invisible Dental Support Organization (IDSO) partnership, from start to finish. “Finish” being the depositing of millions of dollars in your bank account from the sale of 51% to 90% of your great practice to a silent partner. A silent partner which can provide you with the growth resources and equity upside to create tens of millions of dollars of wealth over time.

For “old” doctors, say those over 55, monetizing a part of your life’s work in 2021 is not a hard decision. The tax increases proposed by your President Biden will reduce the value of your practice by 25% in a mere 205 days. It will take you, both young and old, on average, until 2026 to return to the NET after tax proceeds from a sale of part or all of your practice. For old doctors, this is an easy decision, do it NOW. The math is easy. For young doctors, call them 35 to 55, the decision is more complex due to your decades long career horizon.

Wagyu Beef is a Scam

I had dinner last night (supposedly Wagyu beef burger) with a 45-year-old specialist LPS client who is contemplating three offers LPS has negotiated from IDSOs. The lowest of the three is 40% above the market for his practice, standalone. He is a part of a Dental Trifecta which LPS has carefully crafted across his region. (See the Dental Trifecta memo, but in short, it is where LPS assembles pedo, ortho and OMFS clients to achieve higher values for all clients from IDSOs).

The dating process is over and we are now at the time for a decision for the young doctor to move forward with one of the three extraordinary offers, OR, decide to continue his practice growth on his own and monetize later, perhaps in three or four years.

Given that I was in the land of fruits and nuts (and marginal $18.00 burgers) where he will face a potential 53+% tax rate in 2022, this decision is fairly simple. No matter how fast he grows and builds, his practice sale proceeds will be sucked away by massive taxes; exorbitant now, and worse in 2022 and beyond. The majority of this doctor’s growth efforts and money will go to the homeland of Jerry Brown and Kamala Harris, no matter what happens in 2022 and beyond!

The young doctor argued that his practice had experienced impressive growth, even during COVID. He believed that his new, as yet unbuilt office would provide significant EBITDA in the next two or three years, increasing the value of his practice over time. I could not argue with the increase the value angle, he will achieve that growth. BUT, I could discuss Risk vs. Reward; one of my favorite topics.

Like many LPS clients, this doctor has the opportunity to sell 70% of his practice for cash today, at 20% Federal tax rates. His practice today is valued at about $10,000,000, thus he would put $7,000,000 in his pocket, before tax. After the Federal and State taxes (30%) his NET cash after tax, would be about $4,900,000. And he would retain an equity stake of 30% of the $10,000,000 ($3,000,000) in his new IDSO partner. Certainly, the $4,900,000 is nothing to sneeze at, but it is nominal compared to the future value of his $3,000,000 in retained equity with the right partner.

The Big Bet

Most doctors will bet that they can outgrow a doubling of Federal taxes and not make the logical decision to monetize at today’s low tax rates. But only a few doctors have the option to bet that their retained IDSO equity will increase by many multiples, creating far more value with a partner than alone. Higher taxes are a given, understanding the value of a partner is more complex. But as the three+ decade process of the consolidation of dental practices accelerates, the results of bets on IDSO equity have become clearer. In short, it is a pretty safe bet. Many IDSO investors and doctors have achieved 3x to 5x returns in five or so years, and some have achieved 2000% returns in 20 years.

Private Equity (PE) groups have been betting on dental consolidation for three decades. In 2016, they invested $10 billion of equity capital in IDSOs. It must have worked out because in 2019, they invested another $40 billion. And in 2021, it will be far more. There is a reason the PE commitments to dental consolidation have skyrocketed; it is very, very profitable for the investors and the doctors who chose to join them. And it has been lucrative for decades.

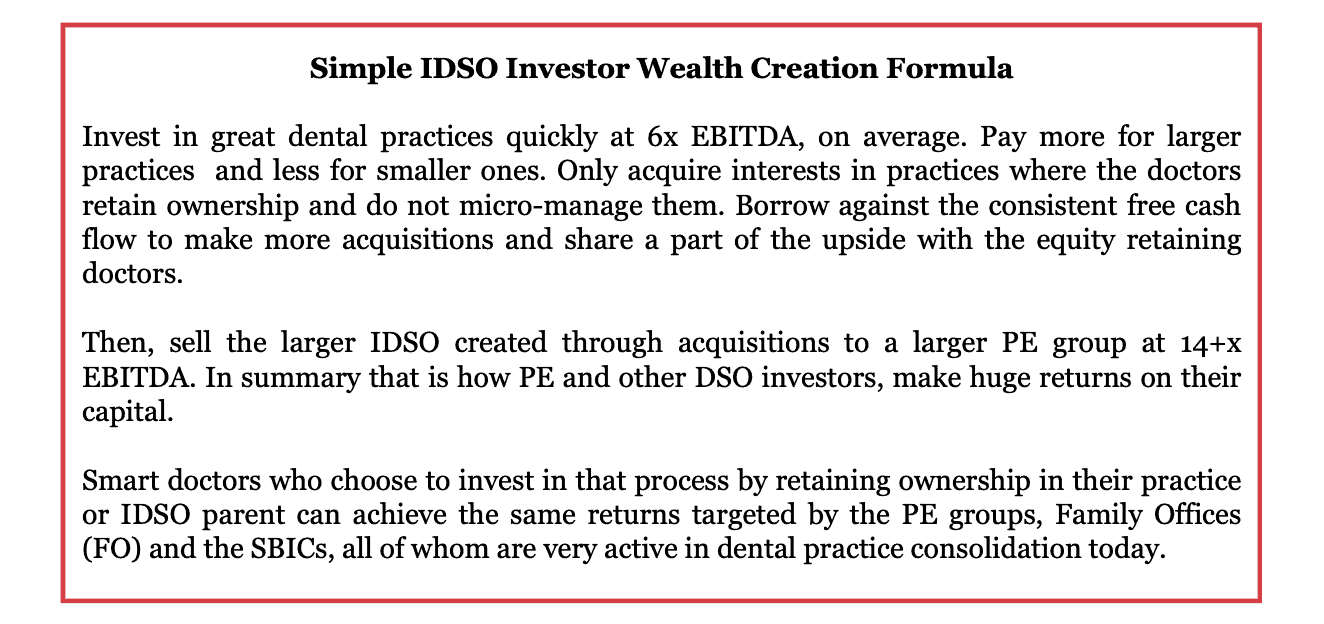

The very smart investors which have made billions of dollars in IDSO investment profits, some in multiple IDSOs, have executed a fairly simple wealth creation formula.

My young client doctor in the story above does not realize that the bidders for his practice fully expect to increase the value of his $3,000,000 in equity (and their own) to over $15,000,000 in the next five years (5x). If he does not sell his equity in five years, and keeps it for the subsequent five years, his $3,000,000 in initial equity retained could become worth 5x $15,000,000+ = $75,000,000 or more in the next ten years.

Sure, maybe he can grow his practice from its $1,000,000 in EBITDA today, to perhaps $3,000,000 in EBITDA over ten years, resulting in a practice worth maybe $30,000,000 in a decade, but he misses out on the “magnification of size”. And this assumes his health remains and we have no more viruses and the dental world around him does not consolidate as the Medical Doctor business has. He has a lot of risk in execution. His risk in waiting is much higher than his risk in selling now.

The doctor’s alternative to growing by himself is partnering with a group of experts worth billions of dollars who want to help him create value. Certainly, they will want to help him pursue his expansion and growth goals, and will even provide 100% of the necessary capital with zero risk to him, but can they achieve it bigger, better and faster? Probably. He is a great dentist, but his new IDSO partner has created billions of dollars in investment value. If you were an outsider, who would you bet on? Smart dentist, or self-made billionaires combined with smart dentists? This is not really a hard decision in my book.

LPS’ Hardest Challenge

In this case, to me, a battle hardened, mercenary business man, this decision is easy. Should the young dentist partner with a brilliant billionaire to build his business or should he do it himself? I personally would rather invest shoulder to shoulder with a billionaire businessman who has millions of dollars at risk (much of it now in the doctor’s pocket). A billionaire investor who is betting on my success from which I can learn from his obvious talents. I would not think I can do it better than he can, by myself.

And you now know LPS hardest challenge; convincing younger dentists (the most valuable of all dentists) that they should take in a silent, wealthy partner. Successful young dentists do not need the cash now and do not believe they can fail. But they also cannot generate these levels of returns by themselves.

Eventually the young dentist needs an exit, the question for them is not just should they monetize now, or later, but should they partner with a smart group to build more value together than he could by himself? To me, the answer is obvious, but to most dentists, it is not, yet. As consolidation accelerates, the answer will become very obvious, but by then, it could be too late.