IDSOs are already in your town or will silently arrive shortly. They will be a friend if you join one or a foe if you do not. You will either benefit from an IDSO’s practice support resources and financial upside, or compete with many of them. It is only a matter of time; consolidation is accelerating due to COVID.

Over the last couple of years, IDSOs have been the most acquisitive groups and are paying the highest values for larger dental practices of all specialties. IDSOs are not a new concept. There are hundreds in the U.S. and some are over 30 years old, with new groups formed every month. They come in all shapes and sizes and are active in all 50 U.S. states (thanks to LPS for adding #49 and #50 in Montana and Wyoming in 2019!).

Many IDSOs own only GP practices, others focus on single specialties and still more which invest in practices of all types. Some IDSOs operate in a single state and the largest has practices in 38 U.S. states. It is adding two practices per week as of Q4, vs. none through 9/30/20. You have not heard of many of the IDSOs as their model is to partner with practices and retain the doctor and his/her team and brand. IDSOs prefer to not be known in any community. The “stars of the show” are the partner doctors, not the IDSO.

Why Doctors Partner with an IDSO

IDSOs can ultimately be a transition vehicle for doctor’s nearing the end of their careers. However, most IDSO transactions are driven by younger doctors who wish continue to practice for at least five years and often decades into the future. Young doctors are eager to benefit from the resources of a large, silent partner to grow their practice, but without personal risk. By partnering with an IDSO and remaining as a partial owner, doctors can:

- Monetize a part of their life’s work for cash now at today’s tax rates, securing their future.

- Gain large potential increases in wealth from the IDSOs equity growth opportunity.

- Reduce administrative burdens.

- Achieve new practice efficiencies in purchasing, team benefits, payor leverage and marketing expertise.

- Create referral synergies with other practices within the IDSO group.

- Access risk free capital for growth through expansion, new offices and acquisitions.

- Gain competitive advantages for both offense and defense in a rapidly changing market.

In a typical IDSO transaction, doctors monetize a part of their life’s work for cash up front. They continue to practice for years or decades with the support of a larger partner to create long-term wealth through equity ownership, far in excess of what they could achieve alone.

Owner Doctors Are Better Operators than Employee Doctors

The bedrock philosophy of an IDSO is that doctors with ownership produce superior operating results and require less management and oversight than an employee run practice. IDSOs may relieve doctors of administrative minutiae, but the doctors remain the leaders and decision makers in their practices.

The branded DSOs have attempted to give employee doctors “owner like” incentives, but it is not nearly as powerful as partnering with a practice where the owner doctor’s name has been on the door for decades. IDSOs believe that an owner doctor’s reputation in the community is far more valuable than any heavily advertised national brand. This is why doctor’s who have long term horizons are more valuable to IDSOs than those who are seeking a fast exit.

A Fit or Not a Fit

IDSOs only partner with practices in which they believe their resources can improve the practice’s performance immediately and over time. During the initial valuation process, IDSOs will calculate potential cost savings and revenue gains in multiple areas including:

- Reductions in supplies and lab costs

- Synergies with other partner practices in the area

- Increases in reimbursement rates

- Reductions in team benefits costs

- Gains from improved marketing efforts

- Potential efficiencies by reducing doctor time spent on administrative functions

Ideal Practice Targets for IDSOs

- Doctors who commit to remain operating the practice for a minimum of five years, preferably forever!

- Practices with consistent, historical growth trends in both collections and EBITDA (net earnings)

- Multiple doctors, low team turnover

- Industry standard margins or better

- Up to date technology

- Little to no government supported payors (except pediatric)

- $500,000 or more in EBITDA

- Doctors in an area of other quality target practices for future or concurrent acquisition

- Younger doctors (LPS has completed transactions for doctors in their early 30’s)

The IDSO Acquisition Math and Logic in Short

The larger a practice or group of practices, the more highly it is valued as a multiple of earnings (EBITDA). In general, IDSO groups can buy practices for X and as a part of a larger group, that practice’s income stream immediately becomes worth 2X.

A single practice may be worth $10,000,000 standalone, but when it becomes a part of an IDSO, it instantly adds $20,000,000 in value to the overall group. The basic math has been true for decades and the financial sponsors of DSOs and IDSOs have executed this play multiple times in dental and many other industries.

IDSOs Acquire Only with Cash and Equity

In a typical IDSO transaction, the IDSO will determine an initial value for the practice based primarily upon its most recent 12 months of EBITDA. They will also review historical results and trends and make pro-forma projections based in part upon the IDSOs added value, but recent EBITDA is still critical to initial value. (Note: COVID era performance is modified.)

Most IDSOs pay between 60% and 90% of the initially determined value in cash at closing. The balance of the initial value is paid to the doctor in the form of EQUITY; ownership in either the practice, the parent IDSO or a combination of both. Each IDSO has different formulas to calculate initial value and the type and mix of equity provided as a part of the initial consideration. Each IDSO has a unique value proposition and their own risks and rewards.

Practice values vary based upon a number of factors and are often time sensitive. As an example, an ISDO attempting to expand in a particular city will pay more for a certain specialty if it drives the value of other practices they now own or are acquiring in the area. LPS recently achieved 2X the market value (over 10X EBITDA) for a smaller pediatric dental practice due to its value add to the IDSO. The IDSO was also purchasing multiple orthodontic and OMFS practices from LPS in the area concurrently.

Earn Outs and COVID

Many doctors are reticent to enter into transactions due to COVID era performance impacts on recent earnings. Virtually all IDSOs are making provisions for COVID earnings declines. Many are providing earn outs in the form of purchase price adjustments for practice results one and two years after closing. For growing practices this will ultimately result in higher values in 2020 than in 2019.

The Real Money for Doctors in an IDSO Transaction; It is NOT the Up-Front Cash

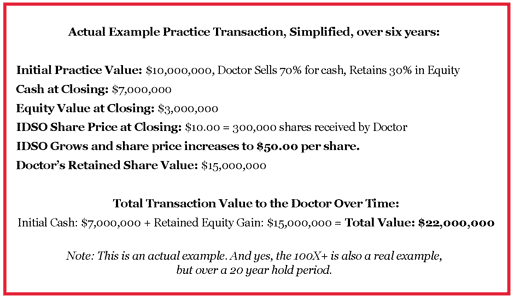

Doctors who retain equity in the parent IDSO or in the practice have upside value gains tied to the success of not only their practice, but the overall group value. Although none are publicly traded, each IDSO has an internally calculated share price. The doctor’s initial equity retained will be issued and valued at the share price calculated at the time of the closing.

As the IDSO grows its earnings, either internally or through acquisitions, its share price increases and thus the value of the doctor’s retained ownership increases. This is no different from any other business. Share prices fluctuate based upon the IDSOs current performance, perceived future value of the business and the recent comparable transactions of similar businesses.

The DSO business has been very lucrative for many investors over decades. This includes large gains for many doctors who exchanged part of the value of their practice for parent company equity. There are multiple examples of IDSOs who have returned 3X, 5X, 10X and even 100X+ the initial equity value to their doctor shareholders. These returns have occurred in time frames ranging from two to twenty years. Many IDSOs have had multiple owners, but retained the same management for decades.

The financial sponsors of IDSOs are predominantly Private Equity funds including some of the world’s largest; KKR, Summit, L. Catterton/LVMH, Bain and many others. In addition, Family Offices and SBICs have recently become very active acquirors and creators of IDSOs. The largest DSO transaction in the U.S. in 2019 was a Swiss family office acquiring a Top 10 U.S. IDSO. A doctor’s ability to join with these types of billionaire investors can be extraordinarily lucrative and unavailable to them as an outside investor.

IDSO Risk and Reward

Unfortunately, as the DSO category has produced consistent returns, numerous investors without track records have entered the industry. Some will be more successful than others and there will be failures. It is critical for doctors to fully understand not only the transaction structures, but the quality of the financial sponsors of any IDSO they are considering as a partner. COVID has proven that the IDSO business is not always as easy as it appears. There have already been several failures in 2020. An experienced advisor is critical.

Summary

If a doctor chooses the right partner, the initial cash and value is only a fraction of the ultimate value achieved over time, even in a relatively short holding period.

- Practice Values, Liquidity and Risks - October 23, 2025

- Attributes of the Most Valuable Dental Practices & Dental Groups in 2025 - June 24, 2025

- The Fears and Concerns About IDSO Partnership - June 11, 2025