The ADA Health Policy Institute (HPI) recently released a research report on the accelerating trend of dental practice consolidation. Notably, the ADA HPI report identifies that the most consolidated segment of U.S. dental practitioners is Orthodontists. Over 18% of all Orthodontic specialists are now employed by, or partnered with, a Dental Support Organization (DSO) or Invisible Dental Support Organization (IDSO). GP and other specialists are not too far behind.

Billions of dollars of new capital has poured into dental practice consolidation in just the last 180 days. Investors and their doctor partners who remain as owners in IDSO partnerships have found U.S. dental practice consolidation to be a growing, low risk, high return investment over the last 35 years; investment success attracts more investors.

Contrary to popular belief, the investors in dental consolidation are NOT only Private Equity investors, but also Sovereign Wealth Funds, Multi-Trillion-dollar conventional asset managers and Family Offices, to name just a few. Thousands of doctors have achieved billions of dollars of gains through their partnerships with IDSOs over the years.

Independent doctors must make the conscious decision to sell out to a DSO, create a silent partnership with an IDSO, or to compete with deep-pocketed, professional investors as an independent practice.

Dentists of all specialties and as young as 30 are increasingly joining IDSOs. In 2022, of LPS’s $612 million in IDSO partnerships, over $100 million were for doctors in their 30s. These doctors are not looking for a transition strategy, but rather a silent partner which will help them as partial practice owners; navigate the increasingly competitive and rapidly changing landscape. Not all practices will qualify to sell 100% to a DSO or partner with an IDSO, but many are doing so now as the economic clouds darken – and liquidity is king.

DSO vs. IDSO; Command and Control or Full Autonomy?

DSO Sale of Your Dental Practice

Practices with less than $1.5 million in annual collections in most cases do not have the opportunity for a high value partnership with an IDSO. Their choice is a traditional doctor to doctor sale of their practice at values often well below 80% of collections. Or, they may choose to sell 100% of their practice to a DSO at similar values.

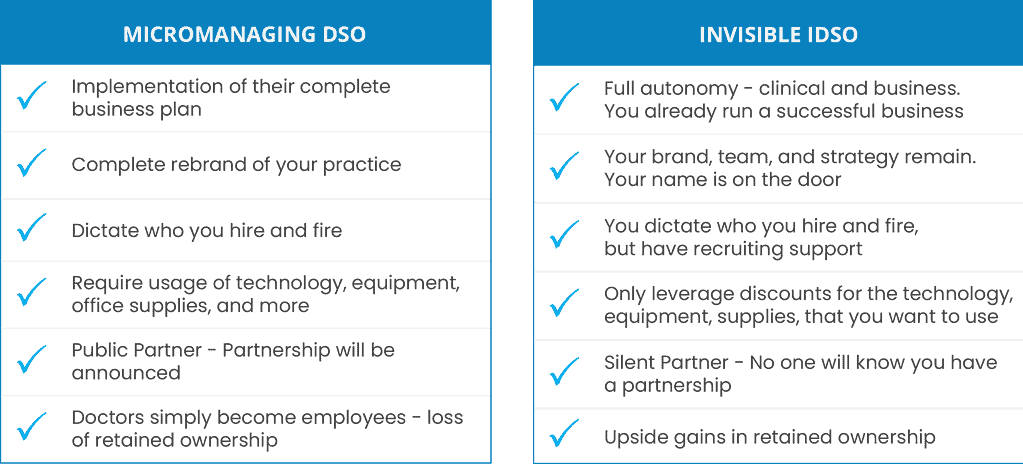

DSOs commonly buy 100% of practices in which the doctor has a limited time frame remaining to provide care. Selling out to a DSO is usually a retirement and transition strategy. Doctors will typically stay for a short period of time after completing a transaction. They will immediately have no management responsibilities, control or autonomy in non-clinical matters.

The doctor’s DSO acquirer will often change policies, procedures, the practice brand, supplies, payors and team responsibilities and compensation. They own 100% so they make 100% of the decisions. Retiring doctors are usually not offended by this element as they have sold 100% of their practice for cash at closing and are heading into a well-deserved retirement!

IDSO Partnership: Sell Part, Not All. Remain as an Owner for Years or Decades

Doctors with over $1.5 million in collections may have the opportunity to create a lucrative, long-term silent partnership with an IDSO. Doctors who have at least a three-year time horizon, and preferably longer, will have the option to gain the benefits of a large silent IDSO partner. Doctors remain as owners continuing to lead their practice with their brand, team, strategy and full autonomy and decision-making control for years or decades.

Practice values in an IDSO partnership are far higher than a 100% sale to another doctor or branded DSO. We have completed transactions for some great, growing practices at values above 500% or 5x collections in 2023 and for many doctors in their 30s.

Hundreds of IDSOs, some over 30 years old, are eager to partner with practices in structures where the doctor sells 51% to 90% of their practice for cash at closing, but retain ownership in the balance. Doctors access the resources of a larger partner to grow bigger, faster and more profitably, but with full autonomy as to how they manage their team and operate their practice.

Doctors choosing IDSO partnership also potentially benefit from rapid increases in the value of the equity ownership they retained either in their own practice or the parent IDSO. In the “recapitalizations” completed in 2022, some LPS clients profited handsomely as the value of their retained ownership increased by over 500% in less than five years, with a few in as short as 35 months.

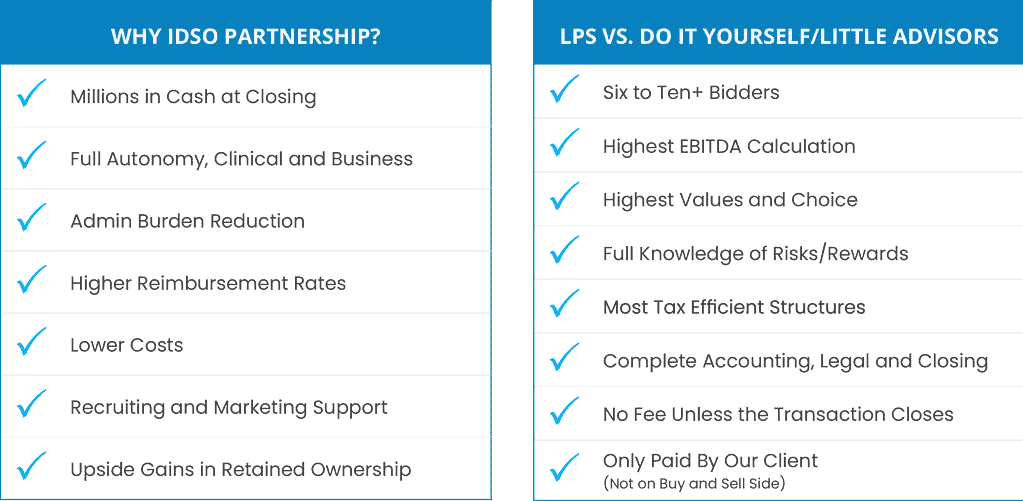

The key to a successful, long-term IDSO partnership is to choose the right IDSO partner. Some will provide stunning returns and a few will fail. A growing practice will often have six to ten or more eager, qualified IDSO bidders to choose from if they select the right advisor to execute an organized bidding process. In a multi-bidder process organized by LPS, doctors are now not only achieving record-high practice values, but are also getting to choose from six to ten or more qualified “brides or grooms”.

Remain an Independent Private Dental Practice

Today doctors are facing increasing complexities and capital requirements in practice ownership and management. Not only are they forced to compete with DSOs and IDSOs with sophisticated recruiting and marketing teams, but those which are buying benefits, supplies, and technology at lower costs than you are. In addition, an IDSO/DSO’s size gives them leverage with payers to achieve higher reimbursement rates than independent dentists. Advances in technology, marketing and training are also driving up costs and complexity, which can be better handled by sophisticated, well-financed partners.

Remaining independent is always a doctor’s prerogative and personal choice. However, you need to be prepared for increasing competition from the doctors in your area which may have gained a powerful IDSO silent partner, unbeknownst to you.

A Hint at the Future of U.S. Dental Practice Consolidation?

A sobering reminder of the future of independent dental practice, may come from the world of MDs. Today over 70% of all MDs are employed by hospitals or corporate groups; a trend which has accelerated in the COVID era. According to the Physicians Advocacy Institute, in 2019 and 2020 alone, 48,400 additional physicians left independent practices and became employees of hospitals or other corporate entities, a trend which is accelerating. MD practices, however, are achieving lower values today than they were early on in the consolidation frenzy.

Whether you decide to sell out to a DSO at the end of your career, or partner with an IDSO, the world of dental practice is changing. Doctors can learn about their various options and practice value today through a no-cost, no-obligation consultation with an LPS principal by contacting us today!

- Attributes of the Most Valuable Dental Practices & Dental Groups in 2025 - June 24, 2025

- The Fears and Concerns About IDSO Partnership - June 11, 2025

- The Emotional Benefits of IDSO Partnership; It is Not All About the Money - May 19, 2025