If you are like the 200+ doctors I talked to in May, your costs are going UP. Conversely your reimbursement rates from payors and your fee schedules are NOT going up.

This usually results in some very simple math; your operating margins and profit (EBITDA) is declining. Since practice values are to some degree (but not always) based upon a multiple of your EBITDA over the last 12 months, (7x to 12x EBITDA in most cases), lower EBITDA causes lower practice values. Some practices will offset this with rising revenues, but not all.

If your EBITDA in the Trailing Twelve Month (TTM) period was $1.0 million, and your practice is worth 7x EBITDA, it is worth $7.0 million today. If twelve months from now, your EBITDA has dropped to $900,000 thanks to higher costs, your practice value is now $6.3 million using the same 7x. Profits down by $100,000, but practice value down by $700,000.

EBITDA Defined: Earnings Before Interest, Taxes, Depreciation and Amortization, but AFTER doctor compensation.

Or put another way, if your costs are going up and your revenues are not, your practice value is declining. We analyze over 1000 sets of practice financials every year to educate doctors on the current value of their practices. In the last 90 days, we have seen a marked increase in labor and supplies costs. We have yet to see a single increase in insurance reimbursements and only very few increases in fee schedules. Inflation hurts profits and reduces practice values directly.

The Next Big Issue; Interest Expense Rising with Inflation

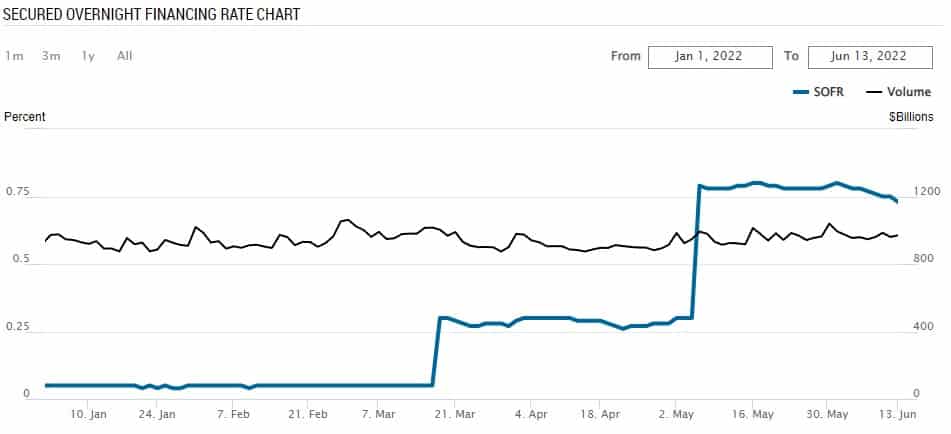

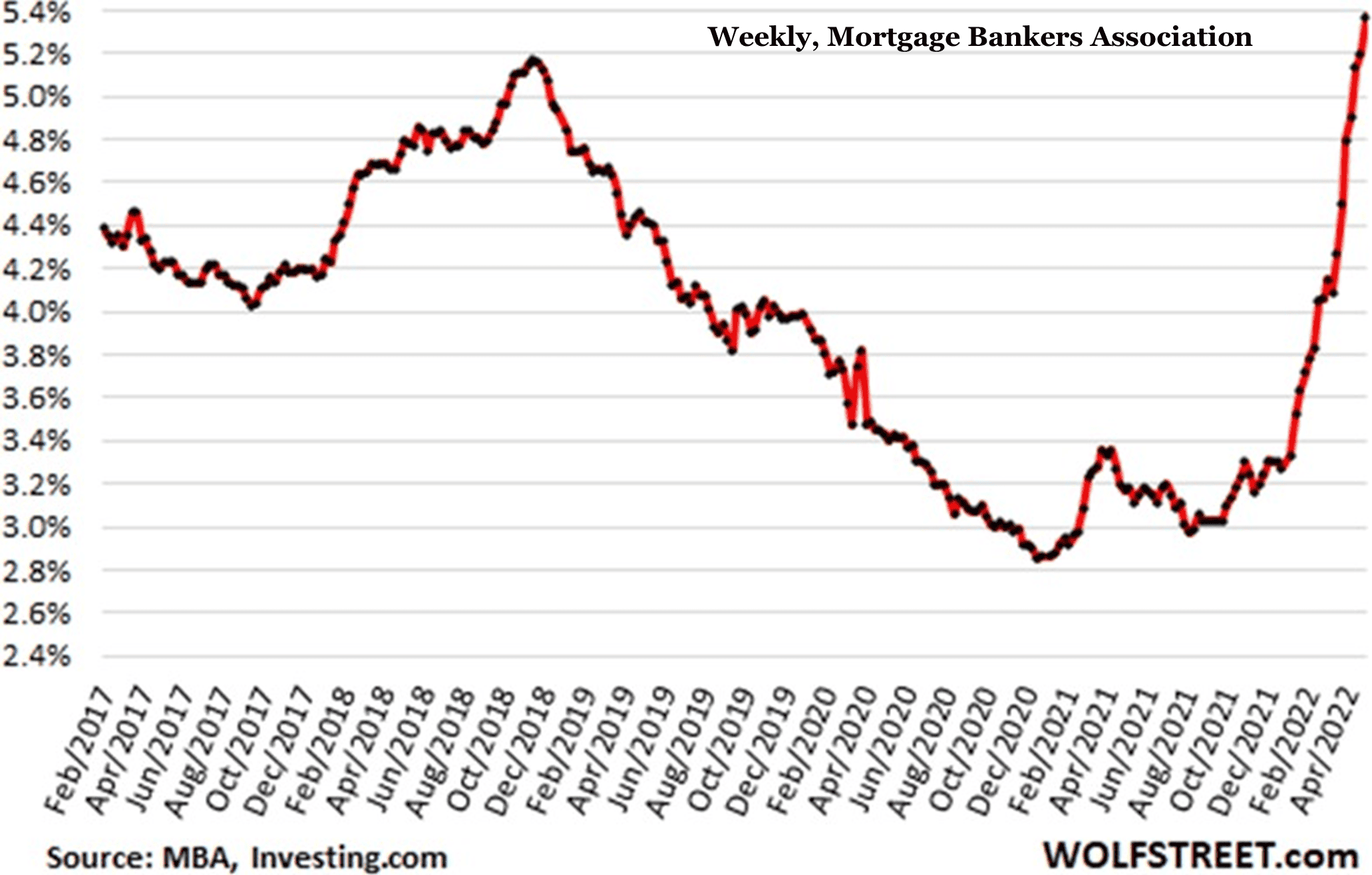

If you borrow money, it is either on a fixed rate or a floating rate. If floating rate, it is tied to some index of national interest rates. Smaller borrowers pay Prime+ X and larger borrowers’ rates are determined based upon SOFR or LIBOR or other indexes and adjust regularly. Lately that adjustment has been UP as you can see in the chart of SOFR below for the period Jan 1 to June 1, 2022. A chart of mortgage rates is also illuminating.

Since EBITDA is calculated without Interest expense, your practice borrowing costs do NOT impact your practice EBITDA and value at all. However, the many IDSOs eager to become your partner virtually all use leverage (DEBT) when financing their investments in new partners. Most IDSOs use floating rate debt. As their costs of financing goes UP, the values they can pay on new partner investments goes DOWN. It is again, a simple math exercise.

The Bigger Picture

While there is well over $1.0 Trillion in “dry powder” (uninvested, committed capital) waiting to be invested in all types of investments by Private Equity (PE) groups globally, their ability to monetize current investments has been impacted by the Public Equity markets and general concerns about the economy.

Private Equity Exit Transactions in Q1 2022 vs. Q4 2021: Down 57%

Initial Public Offerings in Q1 2022 vs. Q1 2021

- Number of Deals Completed: Down 72%

- Total IPO Proceeds: Down 95%

Contrary to Popular Belief: All IDSOs are NOT backed by PE, LPS has completed over $300 million of transactions with IDSOs backed by Family Offices and other sources of capital in the last 30 months. If you do not know the dozens of non-PE backed IDSOs, you should.

More Expensive Borrowing + Fewer Exit Options = Challenges to Practice Values Later in 2022

The ability to borrow cheap money to make acquisitions with an easy fast exit is changing. How this will impact future values is an unknown at the moment. But the “experts” are calling the outlook for transactions in 2022-2023 various unflattering terms including The Hangover (Financial Times). The experts in 2021 who said inflation was “transitory” were wrong, therefore their promises of no upcoming recession are also suspect. (U.S. Treasury Secretary and Federal Reserve Bank Chairman). Recessions generally do not help practice values…

In 2021, there were several IDSOs promising a quick, high value exit for doctor partners via an IPO. Given the crash in the values of the 2021 IPOs (down on average 40%+) this is no longer a promise being made to prospective partners by these IDSOs. Interestingly, the only publicly traded DSO in North America, DentalCorp in Canada (TSX: DNTL) completed an IPO in 2021 and their share price is down about 35% from its high. They plan to acquire $50 million in EBITDA of practices in Canada in 2022. DentalCorp now has over 500 practices and will be entering the U.S. soon.

Summary

If your revenues and EBITDA are growing, you should understand the value of COVID earn-outs in a 2022 transaction as they can increase transaction values by 10% to 40% AFTER closing a partnership. COVID earn-outs will be gone soon. If your practice is not growing, keep an eye on your EBITDA as it is probably declining, along with the value of your practice.

- Attributes of the Most Valuable Dental Practices & Dental Groups in 2025 - June 24, 2025

- The Fears and Concerns About IDSO Partnership - June 11, 2025

- The Emotional Benefits of IDSO Partnership; It is Not All About the Money - May 19, 2025